Big Plans?

Your Life’s Moving, Let’s Get the Finance to Keep Up.

From Homes to Horsepower to Heavy Machinery (We Finance the Fun Stuff.)

Discover Our Core Services

Car Finance

New ride, used car, weekend toy — whatever gets you grinning. We’ll steer you through the finance maze and get you the keys quicker

Explore Car Finance

Home Loans

Smart structure. Fair rates. From first homes to forever homes — we’ll compare over 50 lenders to find your best fit. Get real support from start to settlement.

Learn More

Asset Finance

Smart structure. Fair rates. From first homes to forever homes — we’ll compare over 50 lenders to find your best fit. Get real support from start to settlement.

View Asset Finance Options

More DriveHome Services

Why Australians Choose DriveHome Finance

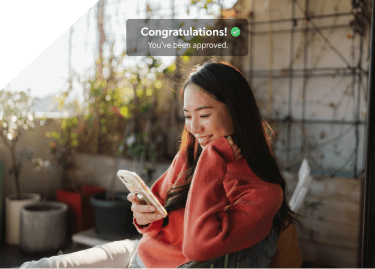

Ready to Get Started?

Tell us what you’re planning, we’ll compare 80+ lenders and find your best deal fast.

What Our Clients Say

Unlock Your Next Home or Ride

Compare 80+ Lenders Now.

DriveHome Frequently Asked Questions

That’s where we come in. The right finance option depends on your goals, your income, how you plan to use the funds, and what kind of repayment structure feels most comfortable for you.

A home loan, car loan, or asset finance each works differently and suits different needs. A home loan is usually a long-term commitment, often with options like fixed or variable interest rates, offset accounts, and redraw facilities. Car finance is typically shorter, usually one to seven years, with choices like secured, unsecured, or novated lease options. Asset finance is designed for purchasing or upgrading equipment, machinery, or vehicles for business use, often structured around cash flow or seasonal income.

Other factors also matter, such as your credit score, deposit size, loan-to-value ratio (LVR), and whether the loan is for personal or business use. Lenders will look at your income stability, existing debts, and how much you can comfortably repay.

We’ll talk through all these details, explain the pros and cons of each loan type, and help you find a solution that makes financial sense for where you are now and where you’re headed next. Our goal is to make sure you understand your options and feel confident that your loan truly fits your lifestyle and goals.

Technically yes, but it’s not always a good idea. Every formal loan application triggers a hard credit check, which can temporarily lower your credit score. Submitting several applications at once can make you look like a risky borrower to lenders.

It’s much smarter to work with a broker who can compare multiple lenders for you — so you only apply for the loan you actually need, with the best possible chance of approval.

Most lenders will ask for:

- Proof of identity: Driver’s licence, passport, or Medicare card

- Proof of income: Recent payslips, tax returns, or business financials if self-employed

- Proof of residence: A rates notice, lease agreement, or utility bill

Bank statements: Showing your income and regular expenses

You may also need to provide details of any existing debts or loans. We’ll let you know exactly what’s needed and help you prepare everything upfront to speed up approval.

That depends on the type of loan and your lender’s processes. Here’s a quick guide:

Home Loans

- Pre-approval: Usually 1–2 business days (conditional)

- Final/unconditional approval: 3–10 business days after you’ve found a property

- Settlement: Typically 1–4 weeks after approval

Car Loans

- Secured car loans: Often approved in 1–2 business days

- Unsecured car loans: Sometimes within 24 hours

Asset Finance

- Generally processed within 24–48 hours, with funds released within 1–5 business days.

We’ll guide you through the process and keep things moving quickly. With no chasing or guessing needed.

Yes. Our brokers are here to make finance clear, not confusing. We’ll walk you through your options, explain the features, fees, and structures of each product, and give advice tailored to your goals. Whether it’s a first home, a new car, or business equipment, you’ll get guidance that’s specific to your situation: not a one-size-fits-all answer.

Ready to Start Your Finance Journey?

We’ll get back to you within one business day — usually sooner.

Finance That Gets You Moving — Real people. Real deals. Real fast.